The Role of Occupancy Tax - Visit Pender County

Occupancy tax, often called a "bed tax," is a crucial revenue stream for local governments and our Tourism Development Authorities, especially in tourism-driven regions like ours. Collected from guests staying in hotels, motels, vacation rentals, and other short-term lodging, this tax directly contributes to the growth and sustainability of our communities.

The benefits of occupancy tax collection extend far beyond tourism. As more visitors are drawn to our area, local businesses, including restaurants, shops, and service providers, experience increased patronage—this economic boost leads to job creation, higher sales tax revenue, and a stronger local economy.

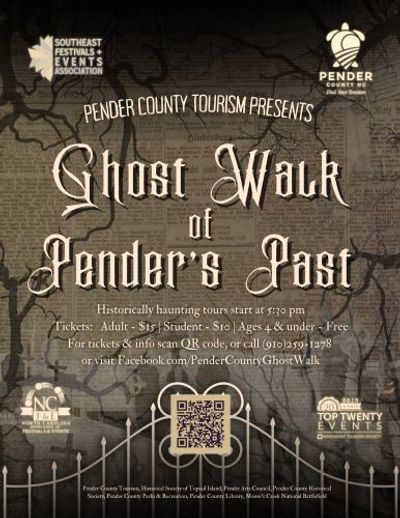

The reinvestment of occupancy tax dollars into the community enhances the quality of life for residents. Improved infrastructure, vibrant cultural events, and well-maintained recreational spaces are just a few of the benefits that make our area an even more desirable place to visit and live.

Occupancy tax collection is a vital tool for fostering tourism and community growth. By reinvesting these funds back into our communities, we ensure that our area remains a vibrant, attractive destination for visitors while also enhancing the quality of life for those who call it home.